An increase in the salaries of the bank employees due to new bank employee pay commission implemented by the Central Government will lead to deterioration of which of the following ratios:

A: Cost to Income Ratio -

B: Net Interest Margin -

C: Core Spread -

- A. Only A

- B. A B and C

- C. Only B

- D. Only C

Answer : A

Project 1: Company X has a sugar mill at Philadelphia and is replicating same at Toronto.

Project 2: Company Y has a sugar mill at Philadelphia and is increasing capacity from 100000 MT to 140000 MT per annum.

What type of projects are Project 1 and Project 2?

- A. Project 1: Diversification; Project 2: Forward Integration

- B. Project 1: Expansion; Project 2: Forward Integration

- C. Project 1: Diversification; Project 2: Expansion

- D. Project 1: Expansion; Project 2: Expansion

Answer : C

Which of the following may lead to the deterioration in credit profile of a bank?

Statement 1. Bank"™s Capital adequacy falling below regulatory requirement.

Statement 2. Rise in Slippage ratio

- A. None of the statement is correct

- B. Both statement 1 and 2 are correct

- C. Statement 1 is correct

- D. Statement 2 is correct

Answer : A

Reference:

https://economictimes.indiatimes.com/industry/banking/finance/pnbs-capital-adequacy-falls-below-regulatory-requirement-due-to-nirav-scam/ articleshow/64573303.cms

During FY13, Small Bazar, a leading retail company has sold three of its prime properties for a sum of USD 24 Million. The same had a carrying value of USD 30

Million.

Analyst had considered the same as operating income and considered it to be part of operating expenses. However, she realized her mistake and recorded the loss as non-operating loss. Which of the following ratio will not change despite the correction?

A) EBITDA Margins -

B) Interest Coverage -

C) PAT Margins -

D) Gross Profit Margin -

- A. B, C & D

- B. A, B & C

- C. B, C

- D. All Ratios will change

Answer : B

Which of the following statements concerning having a CEO serve as chairman of the board is most accurate? Having a CEO also serve as chairman is considered:

- A. poor corporate governance practice as having the CEO server as chairman is an inherent conflict when determining management compensation.

- B. good corporate governance practice as the CEO is the best person to provide the board with information about the company"™s strategy and operations.

- C. cannot be determined

- D. poor corporate governance practice as having the CEO and chairman serve as separate positions ensures a properly-functioning board.

Answer : D

A holder of which of the following types of bonds is least likely to suffer from rising interest rates?

- A. Floating rate bonds

- B. Fixed rate bond

- C. Zero-coupon bonds

Answer : A

Reference:

https://www.nuveen.com/fixed-income-strategies-for-low-and-rising-rates

The most important metric for a bank is the Net Interest Income (NII) which is the difference between____income and____expense.

- A. Interest; Total

- B. Interest; Fee

- C. Interest; Interest

- D. Total; Total

Answer : C

Reference:

https://economictimes.indiatimes.com/definition/net-interest-income-nii

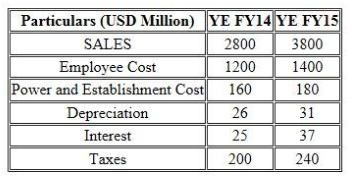

Based on the common size statement analysis which of the following statement regarding employee cost is correct?

- A. The employee cost is expected to contribute 8% to decrease in PAT in FY15

- B. The employee cost is expected to contribute 7% to decrease in PAT in FY15

- C. The employee cost is expected to contribute 6% to decrease in PAT in FY15

- D. The employee cost is expected to contribute 5% to decrease in PAT in FY15

Answer : C

Butterfly strategy is a combination of

- A. Ladder and Barbell on the same market sides

- B. Barbell and Bullet on the opposite market sides

- C. Barbell and Bullet on the same market sides

- D. Ladder and barbell on the opposite market sides

Answer : B

Reference:

https://books.google.com.pk/books?id=WTvNAgAAQBAJ&pg=PA213&lpg=PA213&dq=Butterfly+strategy+is+a+combination+of+Barbell+and+Bullet

+on+the+opposite+market+sides&source=bl&ots=cdWVJkVMRG&sig=XIB-

7YqySq5YDEUmEWusH5JCsjY&hl=en&sa=X&ved=2ahUKEwj3_pCrxN7eAhVkK8AKHYuDCwUQ6AEwBnoECAUQAQ#v=onepage&q=Butterfly%20strategy%

20is%20a%20combination%20of%20Barbell%20and%20Bullet%20on%20the%20opposite%20market%20sides&f=false

Awesome Mobile Ltd is a leading mobile seller who manufactures mobile phone under own brand Awesome. Which of the following is the biggest business risk for

Awesome?

- A. Technology Risk

- B. Branding risk

- C. Raw material price risk

- D. Competition

Answer : C

Based on the Moody"™s KMV model which of the following is not correct?

A: Growth variables are important for default analysis. rapid growth will lead to lower probability of default and rapid decline will lead to higher probability of default.

B: Activity ratios are relevant for default analysis. A large stock of inventories relative to sales will lead to a higher probability of default.

- A. Only Statement A is correct

- B. Both the statements are correct

- C. None of the statements is correct

- D. Only Statement B is correct

Answer : D

Reference:

https://books.google.com.pk/books?id=g8XgCwAAQBAJ&pg=PA67&lpg=PA67&dq=Activity+ratios+are+relevant+for+default+analysis.+A+large+stock

+of+inventories+relative+to+sales+will+lead+to+a+higher+probability+of+default&source=bl&ots=Q-6qbboNbl&sig=iKGUJsn0wKNSv-

F7pZ5B_GElw5E&hl=en&sa=X&ved=2ahUKEwjsruKZwd7eAhUqB8AKHQFGAtAQ6AEwC3oECAsQAQ#v=onepage&q=Activity%20ratios%20are%20relevant%

20for%20default%20analysis.%20A%20large%20stock%20of%20inventories%20relative%20to%20sales%20will%20lead%20to%20a%20higher%20probability%

20of%20default&f=false

In a weakening economy, which of the following is least accurate?

- A. Interest costs go up and create refunding risk for those who have bonds maturing which need to be rolled over.

- B. Interest costs go up and create rate risk for have bonds maturing which need to be rolled over.

- C. None of the other options.

- D. Interest costs go up and create funding risk for those who have borowing plans lined up.

Answer : D

Which of the following is not an importance of the sovereign rating?

A: To arrive at cost of lending to a country

B: To set lower floor for the rating of the corporate and banks of the countries on international scale.

C: For determining the risk levels for international investment portfolios

- A. Only A and C

- B. Only B

- C. Only A and B

- D. None of the three

Answer : B

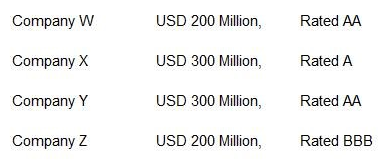

Bank A has an imaginary portfolio of USD 1000 Million distributed towards following four entities:

Bank A is stipulated to maintain a capital adequacy ratio of 11% on its risk weighted assets. It is being stipulated that the ratings for all the four entities is expected to be downgraded by 1 notch each. Estimate the amount of new capital required for Bank A?

- A. USD 93.5 Million

- B. USD 38.5 Million

- C. USD 55 Million

- D. USD 850 Million

Answer : B